Two weeks ago, I embarked on a journey into the Worldcoin universe, starting with the World App. Little did I know, this experience would take me from digital registrations to a physical quest for an 'Orb' in Valencia's 'El Saler' shopping mall.

Worldcoin stands as a groundbreaking venture in the world of cryptocurrency, uniquely blending a futuristic tech experiment with a global financial inclusion project

Its mission is to redefine the distribution and accessibility of digital currency on a global scale, aiming to give free cryptocurrency to as many people as possible. This initiative, akin to a worldwide giveaway, seeks to introduce a broader audience to cryptocurrency, much like offering free samples of a new product. It's trying to get more people all over the world to be involved in the crypto economy.

Founders and Development Team

Overview of Worldcoin and its Goals

At its core, Worldcoin is driven by the vision of democratizing financial resources, ensuring equitable access to digital assets. By offering free access to digital currency, the project aims to encourage more people to engage with and learn about cryptocurrencies, fostering their integration into everyday life and to stimulate the adoption of cryptocurrency globally. This approach distinguishes it from traditional cryptocurrencies that typically target a technologically savvy demographic. The project is anchored in the founding team's belief in making the benefits of digital currency universally accessible, thereby challenging and potentially transforming the current financial ecosystem.

The Founding Team and Their Vision

Worldcoin was created and developed by Tools for Humanity, a San Francisco and Berlin-based organization. It was co-founded in 2019 by Sam Altman, as the CEO of OpenAI, along with Max Novendstern and Alex Blania.

Their collective vision is to harness the potential of blockchain technology to create a more equitable financial future. The organization operates with a mission to use technology for societal benefit. This founding team is driven by the belief that technology should serve a greater purpose in bridging economic divides.

Importance in the Cryptocurrency Landscape

Worldcoin's approach sets it apart in the crowded cryptocurrency landscape. By focusing on widespread accessibility and user-friendly technology, it aims to bring cryptocurrency to an untapped global audience. This positions Worldcoin as a potentially transformative force in the world of digital currency.

Investments and Funding

Detailed Overview of Series C and A Funding Rounds

The Series C funding round, raising $115 million (this particular round valued Worldcoin at $3 billion) and the Series A round, securing $25 million, underscore the financial community's belief in Worldcoin. These rounds attracted significant interest from major venture capital firms, indicating strong confidence in the project's future.

Roles and Contributions of Major Investors like Andreessen Horowitz and Khosla Ventures

The involvement of Andreessen Horowitz and other major investors reflects a recognition of Worldcoin’s potential to make a significant impact. Their investments are not only financial but also strategic, offering guidance and support.

Implications of These Investments for Worldcoin’s Future

The substantial funding secured by Worldcoin is indicative of its potential to become a major player in the cryptocurrency market. This financial backing provides the resources needed to develop and expand Worldcoin’s innovative platform.

The World App: Your Gateway to Worldcoin

The World App is the starting point for anyone interested in Worldcoin. It's designed to be user-friendly, and I found the registration process quite straightforward.

After downloading it from the Google Play Store, I simply entered my phone number to get started. The app introduces users to important terms like World ID and WLD, which are essential to understanding how Worldcoin works.

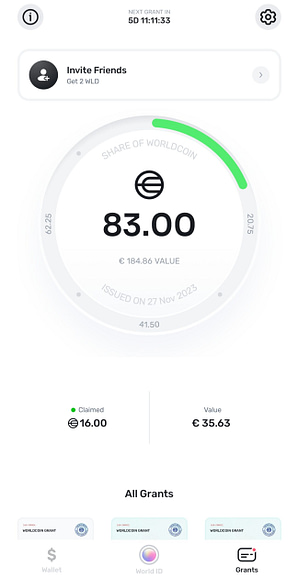

Still I was misled by user interface inside the app. I couldn't understand what that internal circle and big number means. App was updated several times, and now looks a bit better, but still, simple explainer would be helpful.

But as I understand I will be able to get 83 WLD (~182.6€) over the year period.

Every 2 weeks (or at least for the time I was using it) it delivers new grant to my account. Last one was 3 WLD (~6,4 EUR).

Understanding World ID and WLD

World ID is a unique digital identity system that utilizes iris scanning technology to create a unique identity for each user.

The iris scanning process in World ID is designed with privacy and security at its forefront. When a user's iris is scanned, the system encrypts the data and converts it into a unique code. This approach ensures that no raw biometric data is stored, maintaining the privacy and security of user information.

This focus on fair distribution through World ID is a key aspect of Worldcoin's mission. It prevents the same individual from claiming tokens multiple times, upholding the principle of one person, one share. This system is fundamental to Worldcoin's goal of creating an accessible and fair digital currency for all.

WLD is the cryptocurrency token of Worldcoin, akin to dollars or euros but in digital form.

The Role of the 'Orb'

The 'Orb' is a special device used for identity verification through iris scanning. The Orb converts high-resolution infrared images of a person's eyes into an iris code. This code is a mathematical and abstract representation of the iris, used for verifying uniqueness

My encounter with the Orb at a shopping mall. It was very unclear where I can find that "ORB". Any photo in the app, would help me to understand it, but there was no visual information.

The Orb camera set

When I saw the stand, I thought girls are offering some cosmetics and I just skipped them and walked to look for an Orb. Later I figured out, that that stand was Wordcoins stand.

A Worldcoin representative first scanned her QR code from tablet on the Orb and then mine from the app, followed by the iris scan. The process was simple but required a good internet connection and it failed that time. But with the other Orb (there were two on site) it worked. Needed to stand there for about minute while it was scanning my iris.

My Experience with WLD Tokens

After my iris scan, I received additional 3 WLD tokens, totaling 13 WLD in my account. Each token had a value of about 2.2 EUR, giving me a tangible sense of Worldcoin's worth.

At that moment I thought: 'Did I just sold my IRIS picture for ~26€?'.

The use of iris scanning for identity verification brings up questions of security and privacy, which Worldcoin addresses by converting the scanned image into a code and deleting the original image. More information can be found here and here.

Exploring the Optimism Network

The Optimism network is essentially a layer on top of the Ethereum blockchain, designed to make transactions faster and cheaper. It's like a fast lane that helps speed up the processing of transactions, including the transfer of WLD tokens.

Imagine Ethereum as a busy city with congested roads (i.e., the main blockchain), where it takes a long time and costs a lot to travel (i.e., execute transactions). Now, think of Optimism as a special fast lane or a subway system built over this city, allowing people to move around much quicker and cheaper.

In technical terms, Optimism is a "Layer 2 scaling solution." It processes transactions outside the main Ethereum blockchain (Layer 1) but still uses its security and decentralization features. This way, it can handle many more transactions at a fraction of the cost, making it a great option for applications that need faster and cheaper transactions.

For Worldcoin users, the Optimism network means faster and more affordable transactions when dealing with WLD tokens. This is especially beneficial for those who frequently transfer tokens or engage in small transactions, as it mitigates the traditionally high fees associated with blockchain transactions.

Inside WorldApp I found that I have wallets not only for WLDs but also for Bitcoins, Etherium and Digital Dollars. Later I found out that these are not real Bitcoins or Etheriums, but a Wrapped version of it. So here is some explanation about these cryptocurrencies.

- WBTC (Wrapped Bitcoin)

- What It Is

WBTC stands for "Wrapped Bitcoin." It's a way to use Bitcoin in the Ethereum ecosystem. Each WBTC is an ERC-20 token backed 1:1 by Bitcoin.

- Purpose

By converting Bitcoin to WBTC, users can bring the liquidity of Bitcoin to decentralized exchanges and use Bitcoin for Ethereum-based applications, which wasn't possible before.

- WETH (Wrapped ETH)

- What It Is

WETH stands for "Wrapped Ether." It's essentially a version of Ethereum's native currency (ETH) that is compatible with the ERC-20 standard. This standardization allows ETH to be traded more easily with other ERC-20 tokens on decentralized platforms.

- Purpose

ETH, in its original form, isn't compliant with the ERC-20 standards used by many decentralized applications. WETH solves this problem by wrapping the ETH into an ERC-20 compatible format.

- DAI

- What It Is

DAI is a stablecoin cryptocurrency that aims to keep its value as close to one United States dollar (USD) as possible through an automated system of smart contracts on the Ethereum blockchain.

- Purpose

DAI is used to avoid the volatility typical of cryptocurrencies. Its value being pegged to the USD makes it a stable medium of exchange for crypto users.

- USDC (USD Coin)

- What It Is

USDC a stablecoin cryptocurrency that aims to keep its value as close to one United States dollar (USD) as possible. It's managed by a consortium called Centre, founded by Circle and including members like Coinbase.

- Purpose

USDC provides a stable value for transactions, acting as a digital dollar. It's widely used in the crypto market for trading and as a safe haven during market volatility.

- WLD (Worldcoin)

- What It Is

This refers to the Worldcoin (WLD) tokens. Worldcoin aims to be a new, global digital currency that will be distributed to as many people as possible.

- Purpose

WLD is likely part of the initial phase of Worldcoin's distribution and development. It's a means to test, distribute, and integrate Worldcoin into the wider crypto ecosystem.

Comparing the speed and cost of Ethereum Layer-1 and Layer-2 networks

Ethereum Layer-1:

- Speed: The transaction speed on Ethereum Layer-1 is relatively slower due to network congestion. It can handle about 15-30 transactions per second.

- Cost: The cost (gas fees) on Layer-1 can be quite high, especially during peak congestion times. This is because users bid for limited space in each block, leading to higher fees.

Ethereum Layer-2:

- Speed: Layer-2 solutions like Optimism and Arbitrum significantly increase transaction speed by handling transactions off the main Ethereum chain. This can lead to processing hundreds or even thousands of transactions per second.

- Cost: Layer-2 solutions are generally much cheaper in terms of transaction fees. They achieve this by aggregating multiple transactions off-chain before settling them on the Ethereum mainnet, thereby reducing the per-transaction cost.

Layer-2 solutions are designed to alleviate the scalability issues of Ethereum Layer-1, offering faster and more cost-effective transactions. However, it's important to note that the actual speed and cost can vary based on the specific Layer-2 solution and the current network conditions.

Ethereum and ERC-20 Standards Explained

The Ethereum blockchain is used as a main standard for many projects and tokens, largely because of its early introduction of smart contract functionality and the robustness of its platform.

Ethereum, as a foundational blockchain platform, plays a crucial role in the cryptocurrency revolution. Its introduction of smart contracts — automated contracts with terms directly written into code — opened new possibilities in decentralized applications. The ERC-20 standard, essential within Ethereum, sets rules for Ethereum-based tokens, ensuring consistency across different applications.

Imagine you're playing a game where everyone uses different types of tokens for trading. Some of these tokens are square, some round, some triangular, and they all have different rules for how they can be used. This makes trading between players complicated because everyone's tokens work differently.

The ERC-20 standard is like a set of rules that makes all these different tokens work the same way. It's a standard used for making tokens on the Ethereum blockchain. "ERC" stands for Ethereum Request for Comment, and "20" is the proposal identifier. This standard ensures that tokens have a common list of rules they follow, so they can easily interact with each other. This includes rules for how tokens are transferred, how transactions are approved, how users can access data about a token, and the total supply of tokens.

For Worldcoin, operating on Ethereum with ERC-20 compatibility ensures smooth functioning of WLD tokens within the Ethereum ecosystem. This compatibility enables Worldcoin to utilize Ethereum's infrastructure and security features, crucial for integration with various wallets and financial applications.

Here's what the ERC-20 standard does

Uniformity

It creates a standard set of rules that all tokens on the Ethereum network can follow. This makes it easier for developers to create new tokens because they don't have to start from scratch every time.

Compatibility

Because all ERC-20 tokens follow the same rules, they are compatible with each other. This means you can use different ERC-20 tokens in a similar way across various applications and wallets on the Ethereum network.

Simplicity

This standard simplifies the process of interacting with different tokens. For example, if you're using a wallet or an exchange that supports ERC-20, you can manage multiple types of tokens within the same interface.

In summary, the ERC-20 standard makes life easier in the Ethereum ecosystem by ensuring that different tokens can work together smoothly. It's like agreeing on using the same type of currency in a game, so trading becomes more straightforward for everyone.

My interaction with Binance

As I was using Binance crypto exchange and I have a bank card, I sent all 13WLD to my Binance Optimism network wallet. All 13WLD were on my account almost instantly.

On thursday my wife registred her account. She got same 10 WLD. We tried to sent that amount to my Binance wallet but some error appeared (5005 or something). The next day it worked without the problem. It might be that not all confirmation works on blockchain were confirmed to make a transaction or there might be other reasons.

The practicality of Worldcoin manifested when I used my exchanged Euros for grocery shopping, paying seamlessly with the Binance card (yet learned that card won't work from 20th of December...).

Alternatives: Coinbase and Bank Transfers

As alternative I can use any crypto exchange as for example Coinbase to transfer my money. Also in WorldApp there was option to get money directly to bank account but some additional fees will be deducted with transaction.

Upcoming Features: The 'Grand'

The World App displayed a countdown to an upcoming 'Grand', hinting at future token distributions and maintaining the intrigue and engagement with Worldcoin.

And yes when the countdown hit zero, I got the new grand. And counter started to count another 14 days.

Interested in trying it out for yourself?

Here is my affiliate link (everyone receives one upon registration) and full disclosure, I do get rewarded with some WLD tokens if you sign up through it.

My business partner Paul chose not to use it, and that's okay. I'm sharing this to give you the choice to decide whether you want to use it.

I'd love to hear your thoughts on Worldcoin, your personal experiences if you decide to try it, any concerns you might have, or anything else you'd like to share about it.